36+ Usda home loan how much can i borrow

What are USDAs income limits. The current standard USDA loan income limit for 1-4 member households is.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

To be eligible for a USDA home loan your total household income cannot exceed the local USDA income limits.

. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Using a USDA loan buyers can finance 100 of a home. How much can you borrow.

Ad Lock Your Rates For Up To 90 Days. 1 Find a Lender and Prequalify For a USDA Loan. However there are some areas.

The basic VA entitlement is 36000 or 25 of 144000 which was once long ago an almost unfathomable amount to spend on a single-family home. Enter the total gross monthly income youll be using for qualifying. Ad Looking For A Mortgage.

Get Started Now With Rocket Mortgage. Get Your VA Loan. Benefits Of A USDA Loan - Low Rates No Down Payment No PMI.

Find the Best Refinance Option Just for You. USDA annual fees 035 of the loan amount due each year. The interest rate stays at 1 for the life of the loan.

Effective August 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers. Were Americas 1 Online Lender. How to use our how much can I borrow mortgage calculator.

Were Americas 1 Online Lender. Trusted VA Loan Lender of 300000 Veterans Nationwide. This fee is divided into 12 installments and collected as part of the loans monthly payments The USDA backs mortgages.

Ad Looking For A Mortgage. There are a lot of things that can qualify as a compensating factor for the USDA Rural Home Loan. Learn If You Qualify.

Compare Mortgage Options Get Quotes. Ad First Time Home Buyers. Include any commissions bonus pay and other taxable.

To be eligible for a USDA loan you cant exceed the median income by more than 15. It will depend on the amount you can qualify for. Fixed interest rate based on current.

Contact a Loan Specialist to Get a Personalized Quote. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. USDA loans do not enforce.

Compare Mortgage Options Get Quotes. However some lenders allow the borrower to exceed 30 and some even allow 40. Well also take a look at the ratio of your total Pre-Tax Net Income to your.

USDA loans allow financing up to 100 of the appraised value of the property plus the guarantee fee. Take Time To Choose The Best Rate Lower Your Payments. This is based on financial factors such as your salary debts and your credit history.

The USDA home loans do not require a down payment and the home seller is permitted to pay a large percentage of the buyers closing costs. How much can you borrow on a USDA loan. The first step to getting a USDA loan is finding a USDA-approved lender.

Loans amounts cant be more than 20000 and borrowers have 20 years to pay the loan back. The answer for home buyers is It Depends. Its A Match Made In Heaven.

That means you can qualify for a USDA loan with an annual income of 89930 or less. Dont Wait For A Stimulus From Congress Refi Before Rates Rise. So if youre buying a home with a.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. For example if the median salary in your city is 65000 per year you could qualify for a. A general rule is that these items should not exceed 28 of the borrowers gross income.

Its A Match Made In Heaven. Current Mortgage Rates in San Diego1. Check Your Eligibility for a Low Down Payment FHA Loan.

Get Started Now With Rocket Mortgage. Most areas in the country have a 91800 household income limit for a dwelling with one to four people. For a USDA Rural Home Loan it depends on your repayment ability and the appraised value of the home you are buying.

You can easily calculate debt to income ratio figures for all of todayss most popular mortgage programs using this DTI calculator or you can do it yourself using the following debt to income. Use Our Comparison Site Find Out Which Mortgage Lender Suits You The Best. 15 of 78200 is equivalent to 11730 which we added to 78200 to obtain the 89930 income.

Take the First Step Towards Your Dream Home See If You Qualify. The subject home must be located in a approved. Save Time Money.

The income limit for the USDA home loan program is usually 115 of the median household income for the area where the property is located. Ad Prequalify Online Today And See How Much You May Be Able To Borrow. Close a Loan In 25 Days Start Saving Money.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Put Your Equity To Work. The program also makes.

A8ulyhikqf7b0m

Steps To Buying A House Home Buying Tips Home Buying Buying First Home

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Credit Score

Mortgage Loan Processor Resume Sample Mortgage Loan Officer Mortgage Loans Resume Examples

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

Credit Score Chart Credit Score Ranges Experian Equifax Transunion Fico By Www Creditsesame Credit Score Chart Credit Score Range Good Credit Score

How To Get Started With Flipping Houses Flipping Houses House Flipping Business Property Flipping

30 Creative Financial Services Ad Examples For Your Inspiration Home Loans Banks Advertising Mortgage Loans

How To Get A Mortgage From Pre Approval To Closing Home Improvement Loans Home Mortgage Refinance Mortgage

Kentucky Usda Loans Rural Housing Loans Kentucky Mortgage Loans Home Buying Process Home Buying

Investing Calculator Borrow Money

Renting Vs Owning A Home Real Estate Tips Buying First Home Home Buying Tips

Pin By Heather C On Credit Credit Repair Business Improve Credit Improve Credit Score

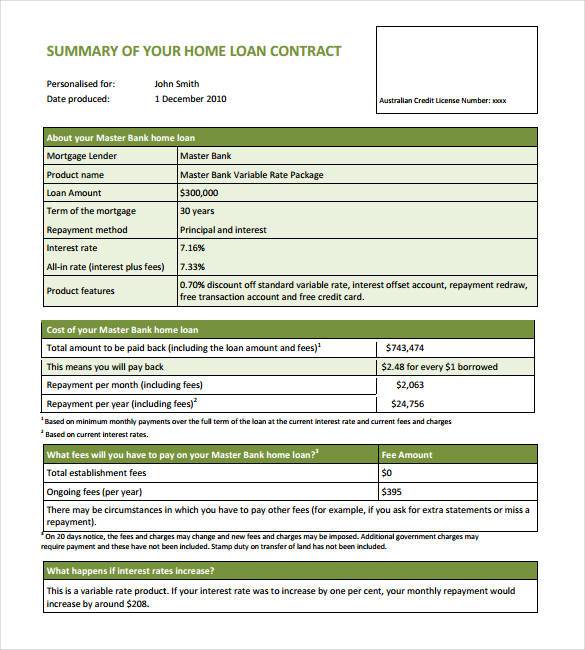

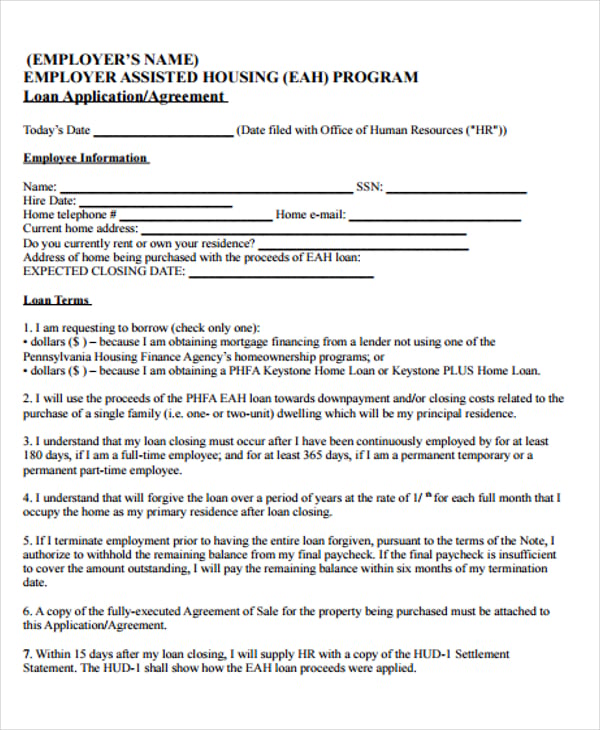

27 Loan Contract Templates Word Google Docs Apple Pages Free Premium Templates

25 Loan Agreement Form Templates Word Pdf Pages Free Premium Templates

This Fact Sheet Provides A Step By Step Approach To Starting Your Agritourism Business Agritourism Agritourism Farms How To Memorize Things

How To Qualify For A Fha Lian Fha Loans Require A 500 Credit Score With 10 Down Or 3 5 Down With A 580 Score See All Requir Fha Loans Mortgage Loans Fha